Financial wealth management represents a sophisticated, integrated approach to managing your entire financial landscape. More than just investment advice, comprehensive “financial wealth management“ encompasses strategic planning across investments, retirement, estate planning, tax optimization, risk management, and succession planning—all tailored to your unique financial circumstances and long-term objectives.

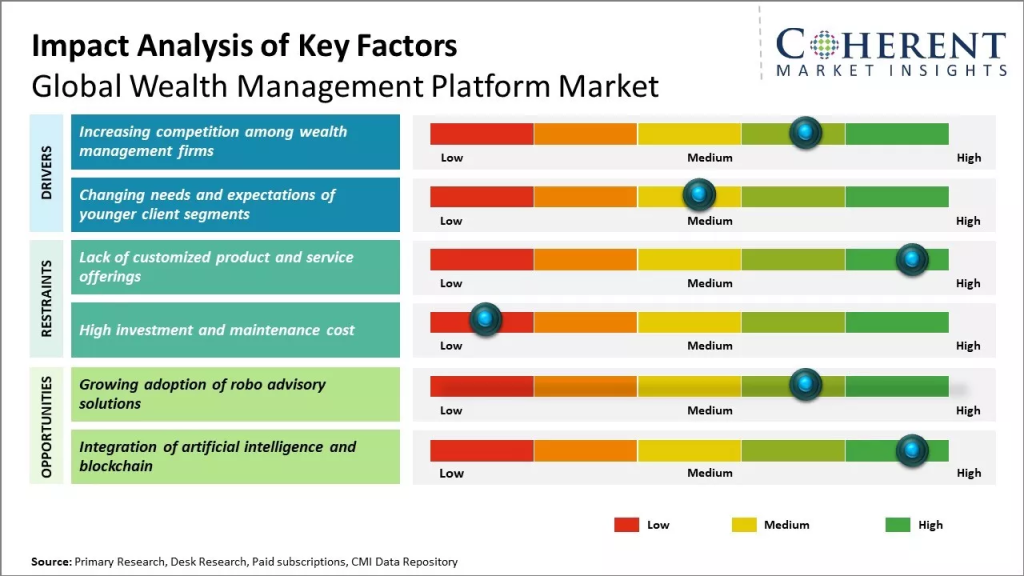

In today’s increasingly volatile economic environment, effective financial wealth management has become essential not only for the ultra-wealthy but for anyone seeking to preserve and grow their assets while navigating complex financial markets. As the gap between basic financial planning and sophisticated “wealth management strategies“ narrows through technological innovation, more individuals are gaining access to these formerly exclusive services.

The essence of financial wealth management is not simply accumulating wealth, but rather creating enduring financial security that aligns with your most deeply held values and aspirations.

Ray Dalio, Founder of Bridgewater Associates

The financial wealth management industry has evolved dramatically in recent decades. While traditional models focused primarily on investment selection, modern wealth management takes a holistic approach that integrates behavioral finance, technological innovation, and collaborative professional expertise to address the multifaceted nature of wealth creation and preservation.

The Integrated Framework of Financial Wealth Management

Financial wealth management operates through an integrated framework that addresses every dimension of your financial life, creating a cohesive strategy rather than isolated solutions to individual financial concerns.

At its core, financial wealth management begins with a deep understanding of your complete financial situation and personal goals. This foundation of “informed decision-making” ensures that every strategy and recommendation is aligned with your specific circumstances rather than generic financial advice that fails to account for your unique needs.

Financial wealth management distinguishes itself from standard financial planning through its comprehensive scope and sophisticated strategies. While financial planning typically addresses discrete goals like retirement or education funding, wealth management integrates these individual objectives into a coordinated strategy that optimizes resources across all financial domains.

The relationship between client and wealth manager is fundamentally collaborative and ongoing. Rather than a one-time financial plan, wealth management involves continuous monitoring, adjustment, and optimization as markets evolve, tax laws change, and personal circumstances shift. This dynamic approach ensures that your financial strategy remains aligned with your evolving goals throughout different life stages.

Core Financial Wealth Management Components

Research by Spectrem Group found that 58% of investors with $5-25 million in assets use comprehensive wealth management services, with investment management, tax planning, and estate planning being the most valued components. Those who work with wealth managers report 15% higher net worth growth over 10 years compared to self-directed investors with similar starting assets.

Fee structures in financial wealth management typically reflect the comprehensive nature of the service. While traditional financial advisors might charge 1-2% of assets under management (AUM), comprehensive wealth managers often use a combination of AUM fees, retainer fees, and performance-based compensation. Understanding these “fee arrangements” is essential for evaluating the true cost and value of wealth management services.

Advanced Investment Strategies for Wealth Accumulation and Preservation

Sophisticated investment management forms the cornerstone of financial wealth management, employing advanced strategies that go beyond conventional asset allocation to optimize risk-adjusted returns across market cycles.

Modern portfolio theory remains fundamental to investment management, but today’s wealth managers extend beyond this framework to incorporate factor investing, alternative assets, and tactical allocation strategies. This multidimensional approach allows for more precise portfolio construction that addresses specific client objectives while managing downside risk.

Free Download

Access our exclusive Financial Wealth Management Blueprint that outlines the essential strategies used by top wealth managers to optimize client portfolios. This comprehensive guide details asset allocation frameworks, tax-efficient investing techniques, and risk management protocols that can help maximize your long-term financial outcomes.Alternative investments play an increasingly important role in sophisticated wealth management portfolios. Private equity, hedge funds, real estate, and private debt can provide valuable diversification benefits, income streams, and return enhancement that traditional public markets may not offer, particularly in low-yield environments.

Using “liability-driven investing” approaches, wealth managers can create investment strategies specifically designed to fund future financial obligations with greater certainty. This approach, originally developed for pension funds, has been adapted for individual investors to ensure that “critical financial goals” can be met regardless of market volatility.

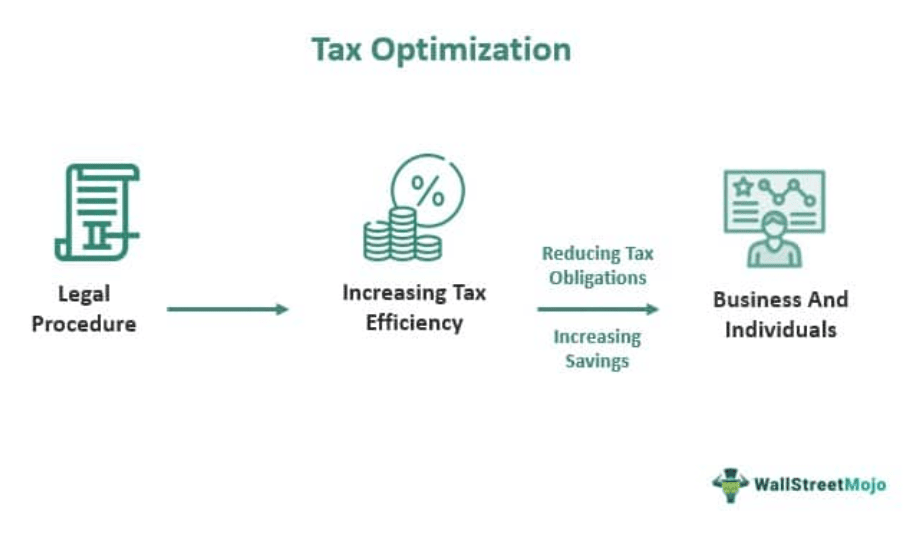

Sophisticated Tax Optimization Strategies

Tax efficiency represents one of the most significant value-add components of comprehensive financial wealth management. Strategic tax planning can dramatically improve long-term wealth accumulation by minimizing tax drag across investments, income, and wealth transfer.

Advanced tax-loss harvesting goes beyond basic end-of-year strategies to systematically capture losses throughout the year while maintaining desired market exposure. These “tactical tax management” approaches can add meaningful after-tax returns without increasing portfolio risk or altering fundamental investment exposures.

Asset location optimization strategically places investments in the most tax-advantaged account types. By carefully distributing assets between taxable, tax-deferred, and tax-exempt accounts based on their tax characteristics, wealth managers can significantly enhance after-tax returns without changing overall asset allocation or risk levels.

Charitable giving strategies present substantial opportunities for tax reduction while advancing philanthropic goals. Sophisticated approaches like donor-advised funds, charitable remainder trusts, and qualified charitable distributions can provide immediate tax benefits while creating lasting charitable impact and potentially enhancing the total assets eventually transferred to both charities and heirs.

Comparing Financial Wealth Management Service Models

The financial wealth management landscape offers various service models, each with distinct characteristics, advantages, and limitations. Understanding these differences is crucial for selecting the approach that best aligns with your specific needs and preferences.

| Traditional Wealth Management | Private Banking | Family Office | Robo-Advisory Plus | |

| Typical Minimum Assets | $250,000-$1M | $1M-$10M | $25M+ | $25,000-$250,000 |

| Service Approach | Dedicated advisor team | Banking & wealth integration | Fully customized, comprehensive | Digital platform with human oversight |

| Fee Structure | 0.75%-1.5% of AUM | 0.5%-2.0% of AUM + banking fees | Flat fee or % of net worth | 0.3%-0.9% of AUM |

| Investment Options | Stocks, bonds, mutual funds, ETFs, some alternatives | Full range including lending solutions | Complete access including direct investments | ETFs, index funds, limited alternatives |

| Tax Strategy | Moderate complexity | High complexity | Maximum sophistication | Basic optimization |

| Estate Planning | General guidance with attorney referrals | Integrated planning with specialist team | Comprehensive multigenerational planning | Basic guidance and tools |

| Best For | Affluent individuals and families | High-net-worth with banking needs | Ultra-high-net-worth families | Emerging affluent, tech-comfortable |

Selecting the Right Financial Wealth Management Approach

Choosing the optimal financial wealth management approach requires careful consideration of your specific needs, preferences, and financial situation. The right solution varies significantly based on your asset level, complexity, and personal engagement preferences.

- Comprehensive needs assessment across all financial domains

- Clear understanding of service model, fees, and fiduciary responsibility

- Evaluation of advisor credentials, expertise, and experience

- Assessment of technology platform and reporting capabilities

Financial wealth management combines technical expertise with deeply personalized service. The most effective wealth managers understand that managing wealth extends beyond financial outcomes to encompass personal values, family dynamics, and legacy objectives. This holistic perspective enables truly tailored strategies that reflect your complete financial identity.

Technological capabilities have become increasingly important selection criteria for wealth management providers. The integration of advanced analytics, scenario modeling, and comprehensive financial dashboards enhances both the client experience and the effectiveness of wealth strategies through improved transparency and more agile decision-making.

4.7Excellent

4.7ExcellentTop Financial Wealth Management Firm: Vanguard Personal Advisor Services

Vanguard Personal Advisor Services delivers exceptional value through its hybrid wealth management approach, combining sophisticated technology with human advisor expertise. With transparent fee structures, comprehensive planning capabilities, and institutional investment expertise, they offer an outstanding solution for clients seeking professional wealth management without excessive costs.

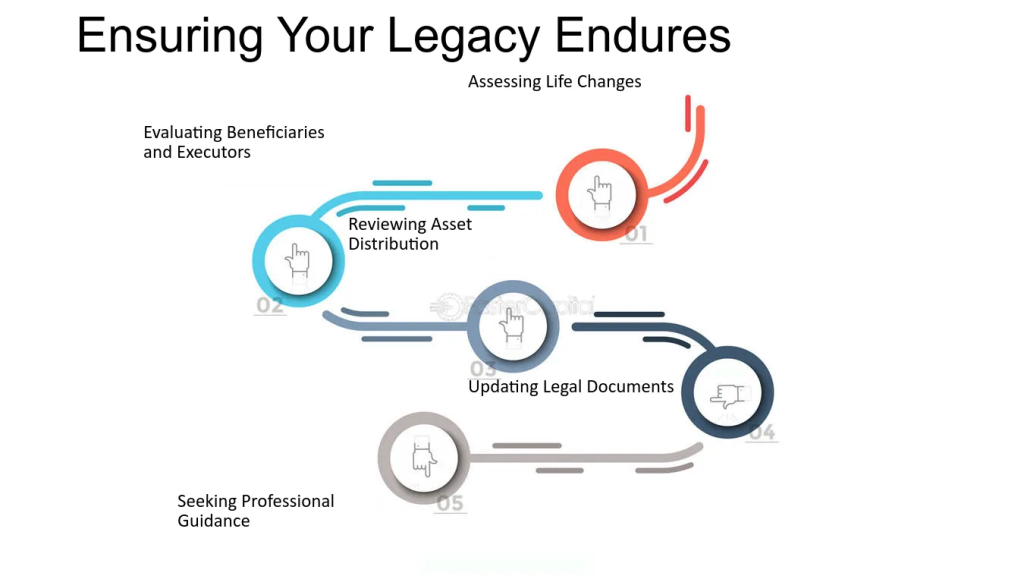

Estate Planning and Legacy Management

Estate planning within financial wealth management transcends basic will preparation to encompass sophisticated strategies for efficient wealth transfer, tax minimization, and legacy preservation across generations.

Modern estate planning addresses both financial and non-financial legacy components. While traditional approaches focused primarily on tax minimization and asset distribution, contemporary wealth management recognizes the importance of “values transmission” and preparation of heirs through family governance structures, education, and communication frameworks.

Trust structures remain central to sophisticated estate planning but have evolved far beyond basic revocable living trusts. Specialized vehicles like intentionally defective grantor trusts, spousal lifetime access trusts, and dynasty trusts offer powerful solutions for specific wealth transfer challenges, particularly for business owners, those with significant appreciated assets, or families with multigenerational objectives.

Business succession planning represents a critical component of estate planning for business owners and entrepreneurs. Comprehensive planning addresses ownership transition, management succession, and financial security while minimizing tax implications and preserving the enterprise value that often represents the majority of family wealth for many successful entrepreneurs.

Risk Management in Financial Wealth Management

Comprehensive risk management within financial wealth management extends beyond investment volatility to address the full spectrum of financial and non-financial risks that could impact wealth preservation and growth.

Insurance solutions form a critical component of wealth preservation strategy. High-net-worth individuals often require specialized coverage beyond standard policies, including umbrella liability protection, specialized property coverage for collections and high-value assets, and customized life insurance strategies designed for estate liquidity and wealth replacement rather than basic income protection.

Concentrated position management addresses one of the most common risk factors for substantial wealth. Whether from employer equity, business ownership, or investment success, concentration in a single asset creates significant vulnerability. Sophisticated wealth managers employ diversification strategies, specialized hedging techniques, charitable remainder trusts, and staged liquidation approaches to reduce concentration risk while managing tax implications.

Cybersecurity and privacy protection have emerged as critical components of modern wealth management. High-net-worth individuals face elevated risks of digital fraud, identity theft, and privacy breaches. Comprehensive wealth management now includes digital asset inventory, “digital legacy planning”, and coordinated security protocols to protect both financial assets and sensitive personal information.

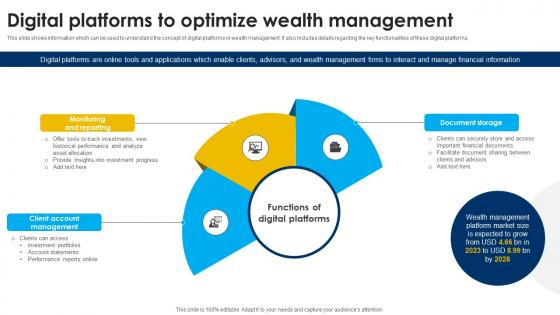

The Digital Transformation of Financial Wealth Management

Technology has fundamentally transformed how financial wealth management services are delivered, creating new models that combine human expertise with digital capabilities to enhance both efficiency and client experience.

Artificial intelligence and machine learning have revolutionized portfolio management and planning capabilities. These technologies enable more sophisticated scenario analysis, identify potential risks and opportunities not evident through traditional analysis, and allow for more personalized investment strategies that precisely align with individual client objectives.

Client portals and financial dashboards provide unprecedented transparency and insight into complex wealth structures. Modern platforms integrate information across accounts, asset classes, and entities to provide a comprehensive view of net worth, performance, and progress toward goals that was previously available only through time-consuming manual aggregation.

Blockchain technology and digital assets present both opportunities and challenges for wealth management. Forward-thinking wealth managers now incorporate digital asset allocation, cryptocurrency estate planning, and tokenized investment opportunities into comprehensive strategies while addressing the unique security, regulatory, and tax considerations these emerging asset classes present.

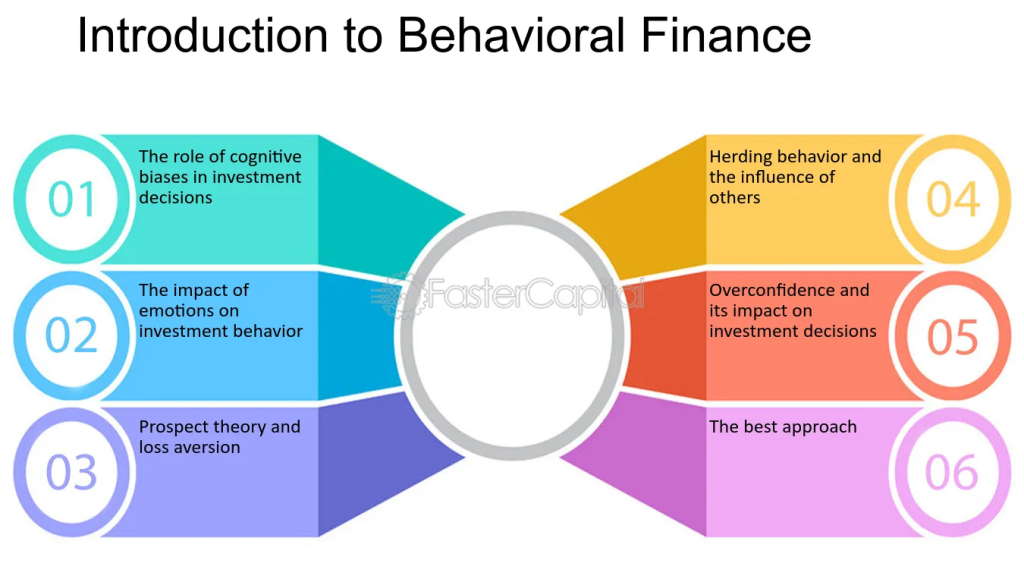

Behavioral Finance in Wealth Management

Modern financial wealth management incorporates behavioral finance principles to address the psychological aspects of wealth decision-making and help clients overcome cognitive biases that can undermine long-term financial success.

Goal-based wealth management restructures the investment approach around specific life objectives rather than abstract performance benchmarks. This framework helps overcome loss aversion and short-term thinking by connecting investment strategies directly to meaningful personal goals with specific time horizons and funding requirements.

Wealth managers act as behavioral coaches, helping clients maintain discipline during market volatility. Research by Vanguard estimates this “behavioral coaching” component adds approximately 1.5% in net returns annually, significantly more than traditional alpha generation through security selection, making it potentially the most valuable aspect of the advisory relationship.

Family dynamics and money psychology play crucial roles in wealth management outcomes, particularly for significant wealth. Effective advisors address family communication patterns, values alignment, and prepare heirs not just financially but emotionally for wealth responsibility. This “emotional inheritance” work can be as important as technical planning in ensuring successful wealth transition and family harmony.

Global Wealth Management Considerations

International dimensions of wealth create additional complexities that require specialized expertise in cross-border planning, global investment management, and multi-jurisdictional compliance.

Global investment diversification extends beyond domestic markets to incorporate international, emerging, and frontier market exposures. Currency management strategies, country-specific risk assessment, and global macro considerations become increasingly important as wealth expands beyond national boundaries.

Cross-border wealth planning addresses the complex interaction of multiple tax systems, inheritance laws, and regulatory frameworks. For individuals with international assets, family connections across countries, or potential future relocation, proactive multijurisdictional planning can prevent costly tax inefficiencies and compliance failures.

Citizenship and residency planning has emerged as a specialized component of global wealth management. Investment migration programs, tax residency considerations, and strategic citizenship options provide flexibility for global families seeking to optimize their geographical diversification while ensuring compliance with increasingly complex reporting requirements and information sharing agreements.

The Future of Financial Wealth Management

Financial wealth management continues to evolve rapidly in response to changing client demographics, technological innovation, and shifting economic realities.

ESG and impact investing have moved from niche interests to mainstream considerations in wealth management. The integration of environmental, social, and governance factors into investment analysis reflects growing recognition that these elements can materially impact long-term performance while allowing clients to align portfolios with personal values.

Demographic shifts are reshaping wealth management priorities and service models. The great wealth transfer—an estimated $68 trillion moving from Baby Boomers to younger generations over the coming decades—is driving increased focus on next-generation engagement, digital service delivery, and values-aligned investing approaches that resonate with Millennial and Gen Z investors.

The democratization of sophisticated wealth management continues through technology and new service models. Strategies once available only to the ultra-wealthy are increasingly accessible at lower asset thresholds through scalable technology platforms, enabling more personalized advice delivery across the wealth spectrum.

Conclusion: Optimizing Your Financial Wealth Management Approach

Effective financial wealth management integrates technical expertise, personalized service, and sophisticated strategies into a cohesive approach that addresses your complete financial landscape while aligning with your deepest values and most important goals.

The most successful wealth management relationships balance professional expertise with client empowerment. While wealth managers provide specialized knowledge and objective guidance, engaged clients who understand the fundamental principles driving their financial strategy typically achieve better outcomes and greater satisfaction with the wealth management process.

Financial wealth management ultimately serves your life goals rather than abstract financial metrics. The measure of successful wealth management isn’t found solely in performance statistics but in the creation of financial security that enables your desired lifestyle, supports the people and causes you care about, and creates the legacy you envision—all while providing peace of mind throughout your financial journey.